Payment processing overview

Charging the Consumer

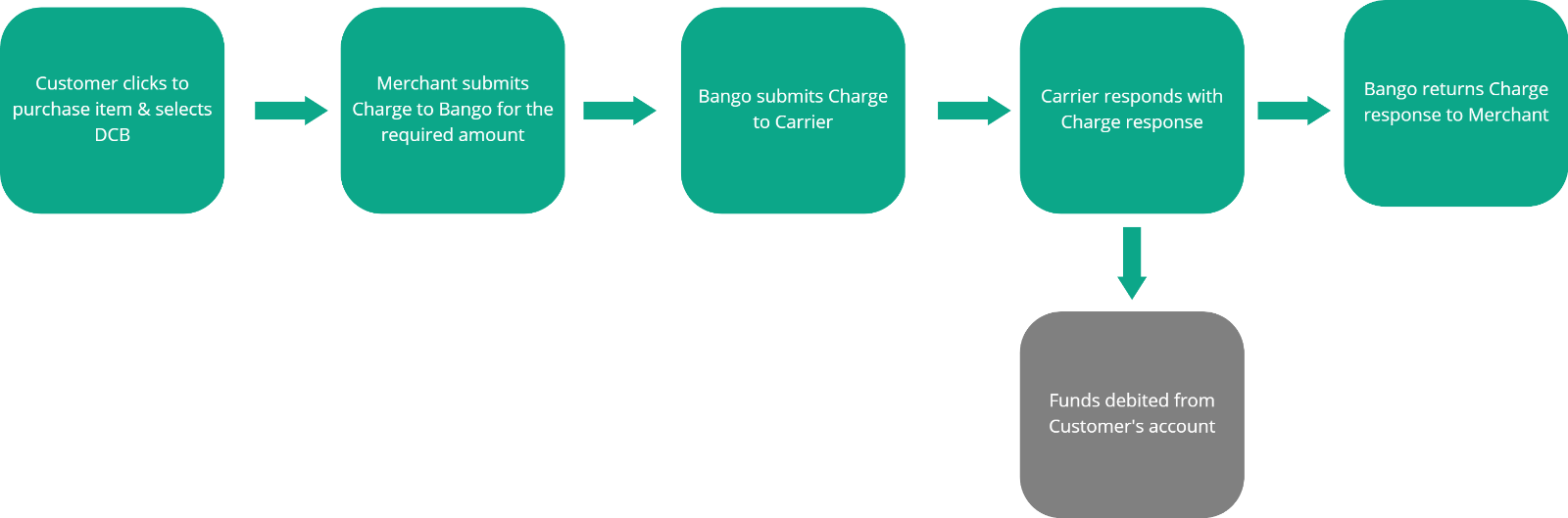

Once a Consumer has been successfully identified, and the Payment Provider has confirmed that they are eligible to make purchases using DCB then the Merchant can initiate the payment.

Bango supports both 1-step and 2-step models for charging the Consumer. The method employed will vary dependent on the payment provider.

Charging the Consumer : Charge (1-step)

With the 1-step “Charge”, funds are immediately transferred to the Merchant if the Authorization is successful. The total authorised amount is transferred, meaning that partial capture requests cannot be applied.

Charging the Consumer : Authorization and Capture (2-step)

When charging with the 2-step method, the payment requires two actions: Authorization and Capture. The Authorization step creates the payment, returning a Transaction Identifier and reserving the funds in the Consumer’s account. The Capture step confirms that the funds should be transferred to the Merchant.

It is possible to submit a partial Capture request to Bango where the funds to be transferred to the Merchant are less than that originally reserved. This sometimes occurs where an item is discovered to be out of stock or otherwise unavailable to the Customer in between the Authorization and Capture steps (these do not need to occur immediately after each other, and a span of minutes, hours or longer between the two is possible).

Only one Capture can be performed within a transaction. it is not possible to Capture any remaining authorised amounts after a partial Capture. A new transaction will be required if a subsequent payment is necessary.

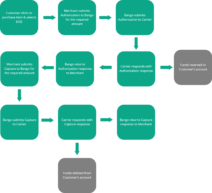

Refund a captured transaction

A Refund allows all or some of the funds previously taken from the Consumer’s account to be returned to them. In 2-step Authorization flows this can happen after the Capture step has been completed, and immediately for 1-step flows.

The Bango platform supports both partial and full refunds. It will check against the original transaction if the amount requested to be refunded by the Merchant remains available for return to the Consumer. This ensures that the Merchant is protected against inadvertently returning more funds to the Consumer than they originally received.

It is possible to process multiple refunds up to the total of the original Captured amount.